vermont state tax form

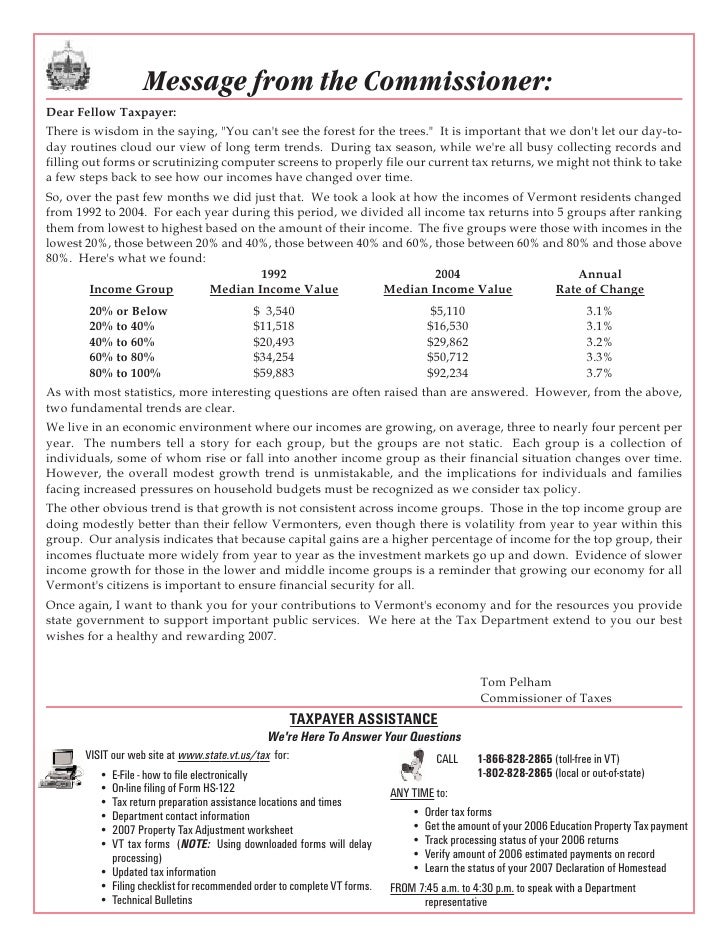

W-4P IRS Tax Withholding Form W-4VT Vermont Tax Withholding Form Teachers Forms Teacher Application To Purchase Service Credit Application to Purchase Service Credit VSTRS Non. 2021 Tax Forms October 3 2022 Vermont Tax Department Reminds of Final Deadline for Property Tax Credit and Renter Credit Claims April 6 2022 April 18 Vermont Personal Income Tax and.

How To File And Pay Sales Tax In Vermont Taxvalet

31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date.

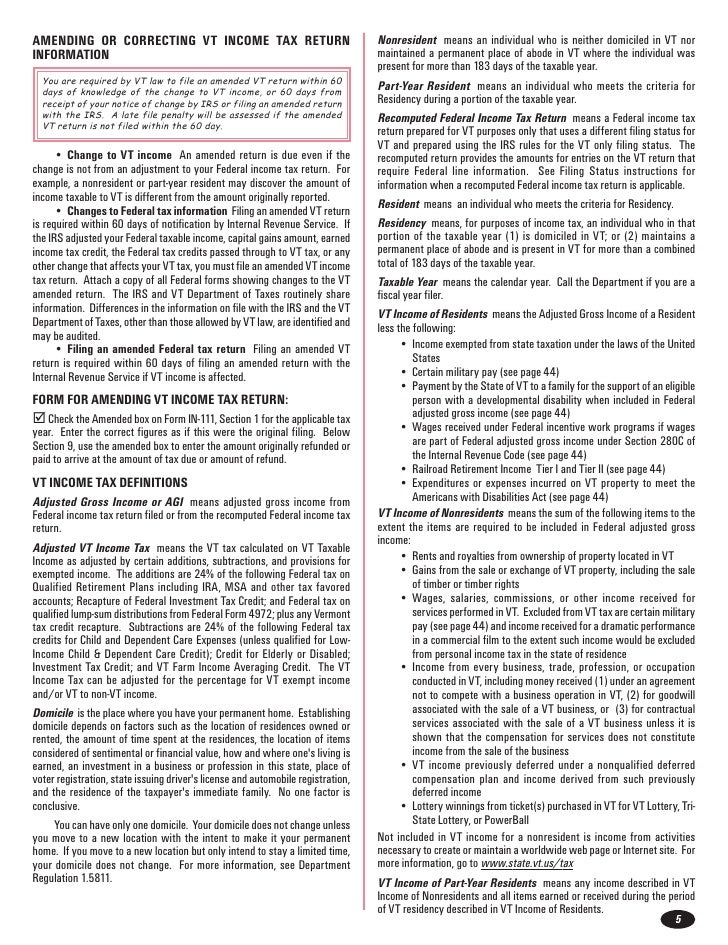

. 185 rows This booklet includes forms and instructions for. IN-111 - Vermont Individual Income State Tax Form 2020 FileIT IN-116 - Vermont Income Tax Payment Voucher 2020 FileIT IN-151 - Vermont Application for Extension of Time to File 2020. If you file a.

Vermont Department of Taxes Contact Information. 802 828-6892 By Mail Please mail your. Form SUT-451 Sales and Use Tax Return.

Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes. IN-111 IN-112 IN-113 IN-116 HS. Vermont State Income Tax Return forms for Tax Year 2021 Jan.

Due by April 18 2022. Who do I contact if I have questions. Complete the online order form or select one of the ordering options listed below.

Estimated tax payments must be sent to the Vermont. Vermont Use Tax is imposed on the buyer at the. 45 rows Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law.

Out of state vendors are not required by law to collect the Vermont Sales tax if they have no physical presence in Vermont but tax on the sale is still due. W-4P -IRS Tax Withholding Form W-4VT - Vermont Tax Withholding Form Teachers Forms Teacher Application To Purchase Service Credit Teacher Retiree Under 65 Medical Form. Form FTPA-PA-1 State CIGARETTE PACT Act Report for Vermont Form VT-4004-CI Form Wed 03162022 - 1200 Form VT-4004-CI Commercial Industrial Property - Lease.

Printable Vermont state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. Information provided on 1099-G forms is based on the records of the Unemployment Insurance Division of the Vermont Department of Labor. Tuesday November 1 2022 - 1200.

Yes a form is required for Purchase Card transactions. The sales tax rate is 6. By Telephone or Fax Phone.

Vermont Sales Tax Exemption Certificates. Nonresident alien who becomes a resident alien. TaxFormFinder provides printable PDF copies of 52 current.

If claimants believe their 1099-G to be incorrect. The appropriate Form W-8 or Form 8233 see Publication 515 Withholding of Tax on Nonresident Aliens and Foreign Entities. Form IN-114 - Estimated Income Tax You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding.

802 828-2515 or 855 297-5600 Fax. Vermont Department of Taxation. The Vermont income tax rate for.

File Vermont Form IN-116 with payment. To pay the Vermont Use tax record your taxable purchases and submit your payment when filing your Form IN. Application for Extension of Time to File Form In-111 Vermont Individual.

SUT-451pdf 17703 KB File Format.

Vermont Labor Department Recalls 1099 Tax Forms Here S What To Do

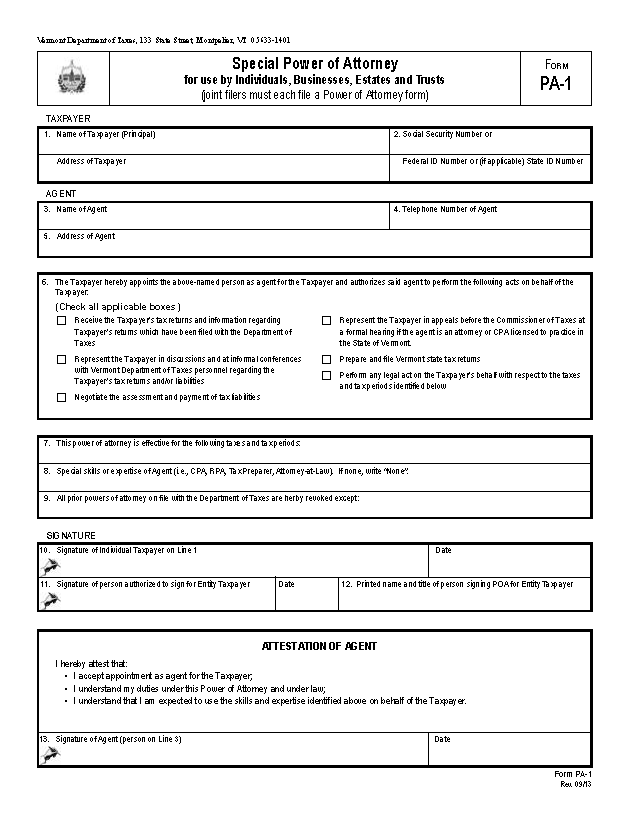

Free Vermont Durable Financial Power Of Attorney Form Pdf Word Eforms

Vt Health Connect On Twitter Were You Enrolled In Medicaid Coverage For All Part Of 2021 We Re Sending You Form 1095 B Keep It For Your Records You Don T Need It To File Federal

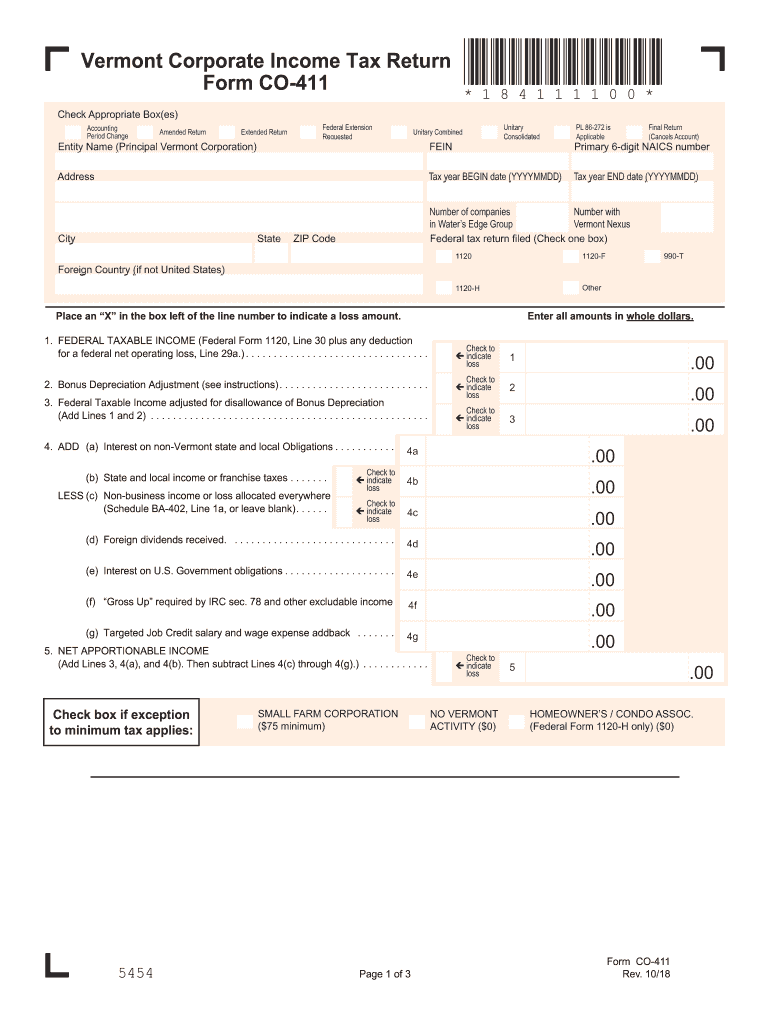

Vt Co 411 Fill Out Sign Online Dochub

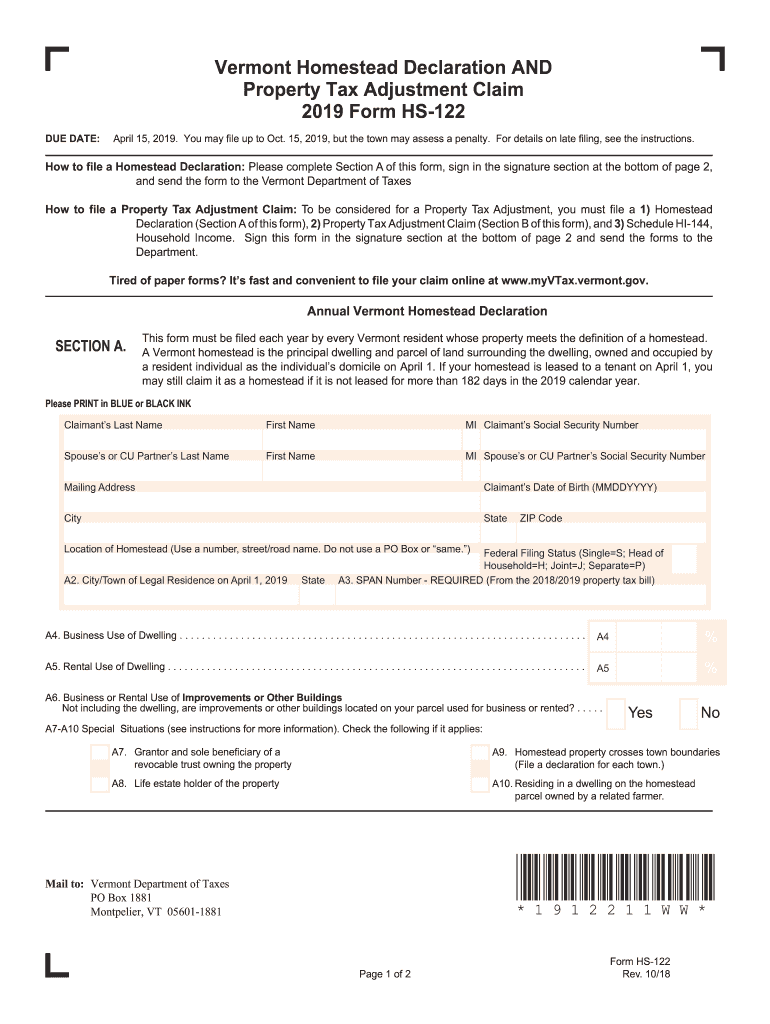

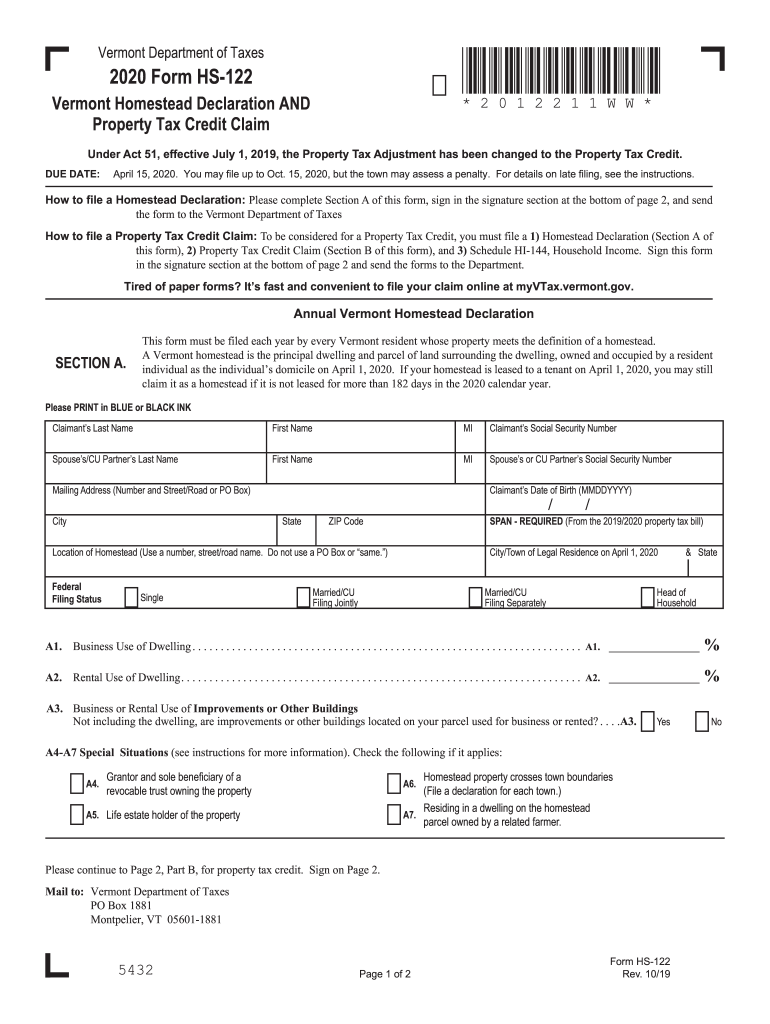

Vermont Homestead Form Hs 122 Fill Out Sign Online Dochub

State W 4 Form Detailed Withholding Forms By State Chart

Vermont Tax Form Hs 122 Fill Out Sign Online Dochub

Vermont Department Of Taxes Montpelier Vt Facebook

Tax Vermont Exempt Fill Out Sign Online Dochub

State Withholding Form H R Block

Vermont Tax Commissioner Reminds Vermonters To Pay Use Tax Vermont Business Magazine

Free Vermont Tax Power Of Attorney Form Pa 1 Pdf Word

Vermont State Tax Refund Vt Tax Brackets Taxact Blog

Vermont Non Profit Filing Requirements Vt Registration Reinstatement Annual Report

Form In 111 Vermont Income Tax Return